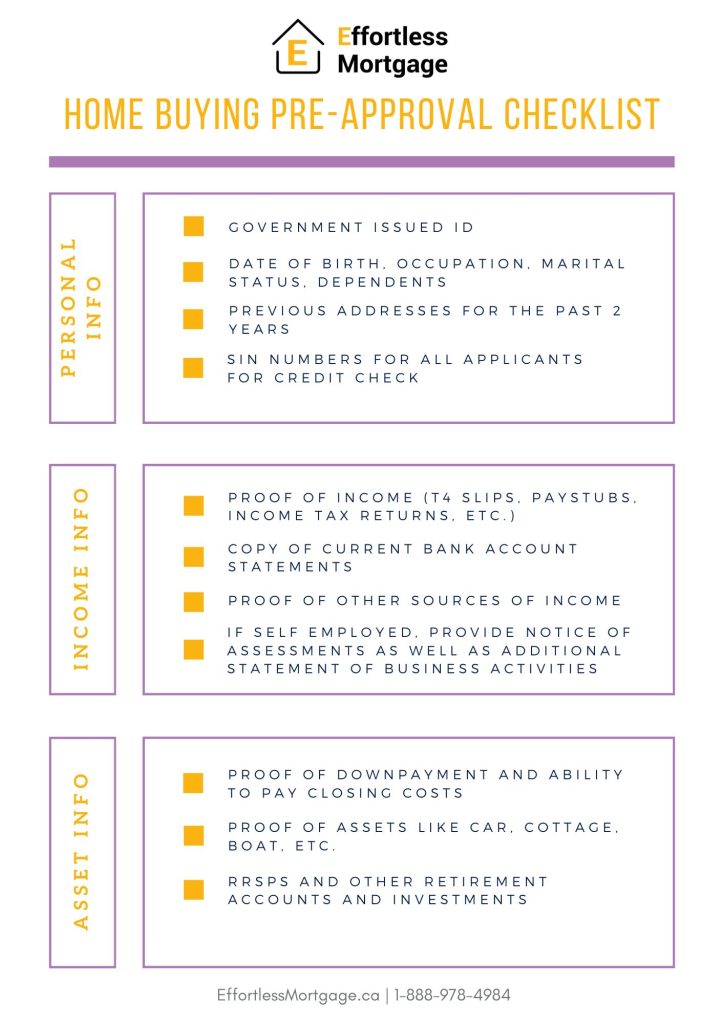

Mortgage pre-approval is your first step towards home ownership. By following this comprehensive mortgage pre-approval checklist, you’re not just preparing for a mortgage, you’re paving the way for a place to call your own!

Mortgage pre-approval is the process where a lender assesses your eligibility for a loan. It involves reviewing your financial situation — including your income, debt, assets, and credit score — to determine how much they’re willing to lend you and at what interest rate. With a pre-approval in hand, you gain a clear understanding of your budget, which is crucial when house hunting.

Time to get organized! It sets the stage for a smoother buying process and helps your mortgage advisor with moving things along with the lender(s).

Once you’re pre-approved, it’s time to start house hunting within your budget. Remember, a pre-approval is typically valid for 90-120 days, so use this time wisely. Keep your financial situation stable — now’s not the time for big purchases or job changes that could affect your eligibility .

Embarking on your home-buying journey with a clear understanding and a solid plan makes the process less daunting and more exciting. Remember, every step you take brings you closer to the door of your new home. So, start with these steps, and soon you’ll be stepping over the threshold of your future.

Your Effortless Mortgage team is available 7 days a week. Feel free to ask any questions about home purchase, home refinance, home renewals, real estate investing, private lending, home equity line of credit, self employed mortgage, bad credit mortgage, and so much more.