Accounts payable and accounts receivable are opposite but interconnected procedures. One represents expenditures; the other represents revenues. Together, they comprise the very basics of business and can be used to gauge financial health.

When accounts payable and accounts receivable are in balance, a business can plan ahead for growth. If out of balance, immediate attention is needed to regain financial wellbeing.

As an accountant, your clients depend on you to help manage their finances. Today, automation plays an important role in optimizing the accounts payable and accounts receivable processes .

For business owners, a working knowledge of both accounts payable and accounts receivable is necessary to sustain business operations. Let’s take a look at their differences.

Accounts payable (AP), is the list of all amounts a company owes to its vendors. This includes products or services that are purchased and invoiced. Generally, when an invoice is received, it’s recorded as a journal entry and posted to the general ledger. When the expense is approved by the authorized employee, a check is cut (digital or hard copy) based on the terms of the purchase agreement. Often these terms are 30, 60, or 90 days from receipt of the invoice.

Accounts receivable is the other end of the accounting spectrum. Accounts receivable (AR) represents the money owed to a company for sales made on credit. Accounts receivable is part of the business life cycle between the delivery of goods or services and the payment for those by customers. They are considered assets on a balance sheet, with expected payments within a year.

Like accounts payable, your clients can set payment terms as part of their accounts receivable strategy. They may also offer customers discounts for early payment or require partial payment at the time of receiving an order.

It is important to note that cash sales, as with a retail client, are not considered part of accounts receivable.

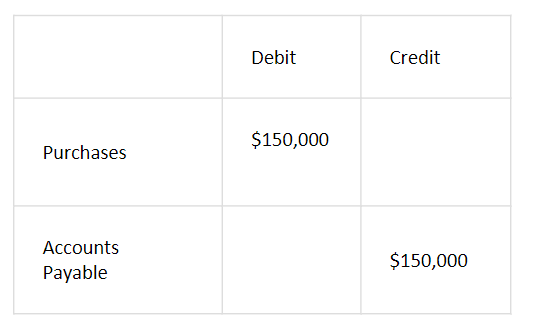

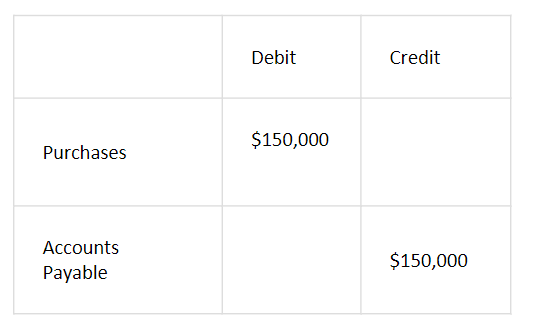

As an example of accounts payable, let’s say that Company ABC purchased goods worth $150,000 on credit from a vendor. Company ABC would record a journal entry as follows:

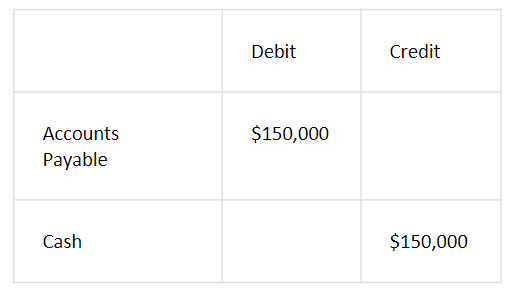

When Company ABC makes a payment to its vendor, the accounts payable account is debited. Below is an example of the journal entry for cash paid to the vendor.

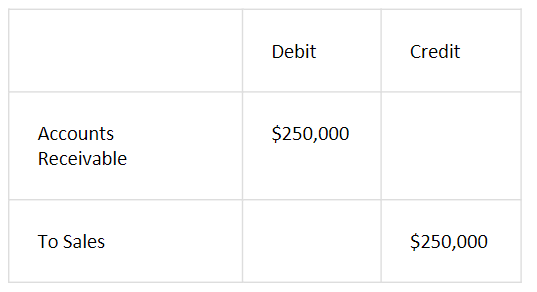

From an accounts receivable perspective, let’s say Company ABC sold $250,000 worth of widgets to Company XYZ on a 90-day period credit. The journal entry at the time the invoice is issued would be as follows:

Therefore, debiting accounts receivable $250,000 means an increase in accounts receivable by the same amount. Similarly, crediting the sales account by $250,000 means an increase in sales by the same amount.

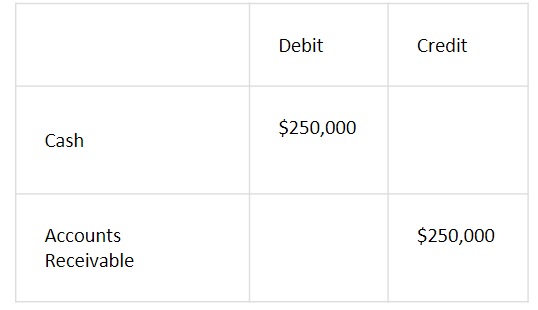

When cash is received for goods sold on credit, the journal entry at the time cash is received would be as follows:

Similar to the above example, debiting the cash account by $250,000 also means an increase in cash account by the same amount. Additionally, crediting accounts receivable by $250,000 means a decrease in the accounts receivable by the same amount.

The Generally Accepted Accounting Principles (GAAP) are a set of rules specific to the United States that are designed to provide oversight for accounting practices. They were developed by the Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Board (GASB).

While internal practices may vary for accounts payable and accounts receivable, every accounts payable department must use a double entry, accrual-based accounting that follows a version of GAAP. Cash-based accounting is not GAAP-compliant.

When it comes to accounts payable and accounts receivable, ensuring the transparency and integrity of financial data is of the utmost importance and is subject to several internal controls.

By automating the accounts payable process , it is much easier to adhere to GAAP while also optimizing the accounts payable and receivable process.

No. The segregation of accounts payable and accounts receivable is important. In fact, the separation of the two functions is considered a fundamental accounting principle, according to the Generally Accepted Accounting Principles (GAAP) issued by the Financial Accounting Standards Board (FASB) . Different people should execute these functions to ensure the risk of fraud is reduced.

With two different individuals handling accounts payable and accounts receivable, discrepancies can often be immediately identified and resolved due to the use of double checks on each side.

If your company is paying an invoice to another company (such as in B2B), it will be noted in accounts payable. Invoices collect payment after a company delivers goods or services to its customers.

The accounts payable balance includes all invoices that are due to be paid to vendors or suppliers for goods or services. It is reflected in the balance sheet under current liabilities.

On the other hand, accounts receivable is where a business records the sale of its goods or services but has not yet collected any funds. Accounts receivable are considered current assets and are listed on the balance sheet.

Billing is part of accounts receivable and is defined as the process of generating and issuing invoices to customers.

If a business provides goods or services without requiring full payment up front, this unpaid balance is categorized as accounts receivable.

An online billing solution can simplify the accounts receivable process by making it faster and easier to send invoices. It also avoids mail delivery issues and streamlines record-keeping.

A job in accounts payable can be stressful if a business relies on manual processes. Without technology to facilitate accounts payable automation , a business may find it hard to manage paper-based documents, reconcile payments in a timely manner, and maintain good relationships with suppliers and vendors.

When it comes to accounts payable, good working relationships are imperative to keep stress levels down. From an accountant’s perspective, your clients’ customers (especially repeat customers) will expect timely invoicing and favorable terms. But with automation tools and proactive communication, accounts payable will not be as stressful as it used to be.

Beyond mere accounting procedures, accounts payable and accounts receivable are the means to understand the financial health of a business. When your clients have a solid handle on accounts payable, they will be able to establish where their money is going and decide how to be more efficient. Conversely, scrutinizing accounts receivable will help your clients understand their profitability and follow up to procure any late payments.

To streamline these processes and much more, consider Accounting CS , a professional accounting software for accountants that combines write-up, trial balance, payroll, financial statement analysis, and more. It’s designed for professional accountants who serve multiple clients, allowing flexibility to handle all types of industry and entity types.

With an intelligent interface that finds and verifies the information you need and integrates with other applications automatically, you’ll spend less time searching for and entering data. Plus, cloud-based accounting lets you work securely with clients in real time and enables your staff to collaborate from anywhere.

For more information about automating accounts payable and accounts receivable for your firm, visit the Accounting CS contact page .

Still have other questions about accounts payable? Check out our accounts payable FAQ .