- Company name

- Address

- Payee ID number

- Payee’s accounts

The data contents of an EDI 820 will always contain unique identifiers to streamline the transaction and facilitate proper cash application.

Is Remittance Advice the Same as an EDI 820?

When you hear “EDI 820” it’s often accompanied by “remittance advice”. What’s the relationship between the two?

Essentially, remittance advice is a type of EDI document that makes up part of an EDI 820 transaction. EDI 820 and remittance advice are often used interchangeably, along with payment order.

Remittance advice is a document that accompanies a payment. It is usually sent by a customer to a vendor to inform them of the payment made and to provide additional details about the debit. It usually includes information such as:

● Payment amount

● Invoice number (or reference number)

● Payment date

● Payment method

● Any other relevant data

If you’re asking, what is an invoice, and is this the same as remittance advice? It is not.

Remittance advice can be sent in various forms, such as a letter, email, or electronic document, and is an important communication tool between the payer and the payee. This document ensures payment is accurately credited to the proper account and that any outstanding balances are resolved.

Remittance advice is commonly used in industries like healthcare, finance, and government.

How do I Send/Receive an EDI 820?

It’s fairly easy to send and/or receive an EDI 820. The transmission is done through the internet or a Value Added Network (VAN). To save money, use an AS2 or secure FTP. This eliminates the need for an expensive VAN. Files are always encrypted to keep the data secure and safe.

Translating the EDI 820

When an EDI 820 is received, it must be translated into a functional format for your system. Most organizations have their own standard set of definitions for EDI 820s. Once translated, the order information is automatically synced and mapped, eliminating the need for manual data entry. When all data elements are in the system, the order can be processed.

Sample edi 820 in raw format." width="768" height="424" />

Sample edi 820 in raw format." width="768" height="424" />

How Do I Use an EDI 820?

EDI 820 documents act as a statement of intent to pay. After the buyer sends the remittance advice transaction set (RMR) to the accounts receivable department, the matching begins. There should be a counterpart EDI 810 invoice or purchase order to settle the open account.

In general, EDI integration happens with a funds transfer to confirm payment details to the seller. However, an EDI 820 document is also used to advise the seller of important adjustments to the invoice that could change the payment amount.

Additionally, an EDI 820 is sent to provide instructions for payment to the associated financial institution. It may also entail information on previous payments for the same invoice.

While an EDI 820 is triggered by the receipt of an EDI 810 invoice, buyers can choose to send the document when they receive an invoice in any format. The seller’s bank may also issue an EDI 820 to the seller upon receipt of payment.

After the EDI 820 is received by the seller, their EDI solution will generate an EDI 997 Functional Acknowledgement. This document is sent back to the buyer to confirm receipt. This officially marks the end of the order process.

What are the Benefits of EDI 820?

Whenever a business does anything electronically, it equates to less manual labor and more efficient operations. An EDI 820 frees up resources and reduces human error.

When translated, the EDI 820 containing the same information as regular, paper remittance advice. However, the data encryption used for the EDI keeps the buyer, seller, and payment information much safer. It supersedes traditional methods like mail, fax, or PDF.

By automating the B2B payment process, both buyers and sellers can streamline order management. Buyers save on a paper trail. For sellers, automation enables a business to oversee accounting through exceptions.

This means, accounting only needs to address open accounts when they are alerted to an issue, rather than watching everything, all of the time. They don’t need to re-enter data or issue functional acknowledgments manually for each individual order.

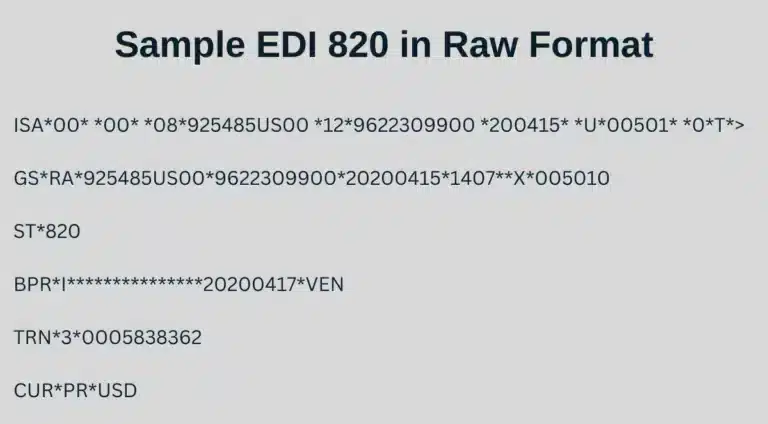

EDI 820 Format Example

An EDI 820 looks like a line of code until translated. It can be viewed in two ways. The human “readable” format or the “raw data” version. The example below demonstrates what an EDI 820 looks like before being translated by your ERP and reconciled through accounting.

The Interchange Envelope (often referred to as the IEA) is the wrapper for all the data to be sent in one transmission.

The Future is Electronic

Although you may send EFTs through the Automated Clearing House (ACH), an EDI 820 doesn’t require a third-party agent. It’s part of an electronic payment system designed to streamline business and automate processes.

An EDI 820 is simply a way to facilitate the sharing of financial data. It provides a fast, safe, and reliable data exchange method for a business of any size.

Have more questions on different payment methods and systems? Check out our ebook, Comparing the Top Global Payment Methods, for a more in-depth look.

About the Author

Brianna Blaney began her career as a fintech writer in Boston for a major media corporation, later progressing to digital media marketing with platforms in San Francisco. She has worked as a financial writer for Tipalti for 7+years, keeping a close eye on shifting trends and reporting on the ever-evolving landscape of financial automation. She prides herself on reverse-engineering the logistics of successful content and implementing techniques centered around people (not campaigns). In her spare time, she loves to cook and take care of her pet squirrel, Marshmallow.

Netsuite ERP on a tablet in an office." />

Netsuite ERP on a tablet in an office." />